Gold and Bitcoin demystifies two monetary assets with data. You’ll learn how bitcoin works—blockchains, hashing, mining, keys, and transactions—and why decentralization matters. Then we compare gold and bitcoin where they are similar—scarcity, low inflation, high production cost, and absent cash flows—and where they diverge: custody, divisibility, auditability, settlement, censorship resistance, volatility, market size, and institutional adoption. We connect market structure to portfolio design, showing when each asset helps during equity drawdowns or inflation shocks. You’ll also understand today’s price drivers: financialization (ETFs, tokenized gold), central-bank accumulation, de-dollarization, and reserve-currency politics, plus a policy wildcard—potential Basel III treatment of gold as a high-quality liquid asset. Finally, we confront tail risks: bitcoin’s 51% and quantum threats and gold’s technological supply shocks (advanced extraction, modern alchemy, and off-world sources). Throughout, we use the golden-constant and Golden Dilemma frameworks to anchor valuation and build scenarios. Leave with clear, evidence-based answers and practical allocation tools you can apply immediately.

Gold and Bitcoin

Ends soon: Gain next-level skills with Coursera Plus for $199 (regularly $399). Save now.

Recommended experience

What you'll learn

Analyze gold vs. bitcoin with data—scarcity, inflation, costs, custody, and portfolio impact.

Understand current price drivers—financialization, central-bank buying, de-dollarization, and reserve-currency politics.

Assess tail risks: bitcoin’s 51% and quantum threats; gold’s supply shocks from advanced extraction, recycling, and off-world sources.

Skills you'll gain

Details to know

Add to your LinkedIn profile

October 2025

4 assignments

See how employees at top companies are mastering in-demand skills

There are 4 modules in this course

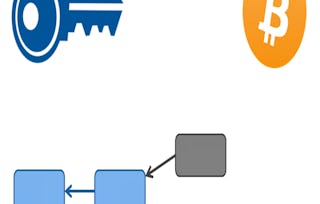

This module presents the first-principles intuition for bitcoin by unpacking the technology stack that makes it work. We begin with blockchains as append-only, distributed ledgers that remove single points of failure and allow many parties to share a synchronized record without pre-existing trust. You’ll see how cryptographic hashing (SHA-256) links blocks, why “one-way” functions matter, and how proof-of-work turns security into an open, global competition. We then follow a transaction end-to-end: private keys create public addresses, digital signatures authorize spending, and miners bundle validated transactions into blocks roughly every ten minutes. With that foundation, we examine mining mechanics (nonces, difficulty, incentives) and why decentralization—anyone can run a node or mine—is a design feature, not an accident. Finally, we zoom out to decentralized finance: what problems bitcoin and its successors try to solve (inefficiency, limited access, opacity, centralized control, and poor interoperability) and how “layer 2” systems aim to improve speed and cost. The goal: translate buzzwords into working knowledge so you can evaluate bitcoin’s capabilities and limits with rigor.

What's included

7 videos2 readings1 assignment

This module compares bitcoin and gold on the dimensions that make them “monetary commodities.” Both are scarce, hard to counterfeit, expensive to produce, and decentralized in supply. We quantify inflation from the source: for gold, mine output relative to above-ground stock; for bitcoin, the protocol’s halving schedule and the practical effect of lost coins on effective supply. Neither asset generates cash flows on its own, yet both can be “financialized” (ETFs, tokenized forms, or lending) to create yield-like streams with attendant risks. We analyze production economics: high, persistent energy and capital costs; location flexibility for bitcoin miners versus geology-bound gold producers; and why electricity is a first-order driver for bitcoin but one among several for gold (labor, maintenance, exploration). Finally, we emphasize decentralization: no single entity controls issuance, and concentration risks are lower than in fiat regimes. This section equips you to separate narratives from mechanics when judging scarcity, inflation, and cost—core inputs to valuation and portfolio design.

What's included

4 videos1 assignment

This module shows how similarities fade when we examine intrinsic nature, market structure, and trust models. Gold is physical: it requires custody, purity testing, and logistics; it is heavy to move and awkward to subdivide. Bitcoin is digital: instantly auditable on a public ledger, natively divisible into 100 million “sats,” and globally portable with a key. We compare monetary characteristics (seizure and counterparty risk for bank-held gold versus key-management risk for self-custodied bitcoin), settlement (multi-party supply chains for bullion versus on-chain finality), and censorship resistance (low for cross-border gold, high for bitcoin). Markets differ too: gold’s capitalization is much larger, with deep official-sector adoption (central-bank reserves), while bitcoin’s liquidity and volatility profiles are distinct and more extreme. We conclude with regulatory and geopolitical contrasts—legal-tender status, bans, sanctions evasion channels—and the practical implications for portfolio construction, rebalancing, and stress scenarios. The upshot: not substitutes, but different instruments with diverse use cases and risk vectors.

What's included

8 videos1 assignment

This module tackles asset-specific tail risks. For bitcoin, we analyze a 51% attack—how the majority hash power could reorder transactions—and estimate the capital, energy, and infrastructure requirements to launch an attack. The analysis suggests that the cost of a 51% attack is modest compared to the potential profit when bitcoin is shorted. We then separate two quantum vectors: Shor’s threat to elliptic-curve keys (mitigable via post-quantum migration) versus Grover’s far less practical impact on SHA-256 mining. For gold, we examine technological supply shocks that bitcoin does not face: “modern alchemy” (nuclear transmutation pathways), new on-Earth sources (oceans, with daunting economics), and off-Earth sources (metal-rich, near-Earth asteroids) that could, in time, expand supply and pressure real prices. Historical analogies (e.g., New World inflows) show how sudden supply can reset monetary metals. We close by arguing that the thinking of bitcoin as “digital gold” is an oversimplification. Bitcoin is not a substitute for gold. Both assets have a role in diversified portfolios.

What's included

6 videos1 reading1 assignment

Instructor

Offered by

Explore more from Finance

Status: Preview

Status: PreviewDuke University

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Status: Free

Status: FreePrinceton University

Status: Free Trial

Status: Free Trial

Why people choose Coursera for their career

Frequently asked questions

To access the course materials, assignments and to earn a Certificate, you will need to purchase the Certificate experience when you enroll in a course. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you purchase a Certificate you get access to all course materials, including graded assignments. Upon completing the course, your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile.

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

More questions

Financial aid available,